Building a thematic investment portfolio

How do thematic funds fit into a portfolio?

Thematic funds, which grew in popularity during the Coronavirus pandemic, typically built around themes, including energy transition, to connectivity, to artificial intelligence, to cannabis and to disruptive healthcare technologies.

As a recent report from Morningstar showed, with the "menu" global thematic funds expanding rapidly in recent years, the proliferation of funds has also added some confusion to the market, with investors having to sift through a fast-growing supply, some with greater complexity, and some with more refined niches.

So how do thematic funds fit into a portfolio?

This report is worth 30 minutes of CPD.

Less than a third of adviser clients familiar with thematic investing

The majority of adviser clients are not familiar with the term thematic investing, according to the latest FTAdviser Talking Point poll.

Advisers were asked: what proportion of your clients are familiar with the term "thematic investing"?

Almost all those who responded to the survey — 97.2 per cent — said less than 30 per cent of their clients understood the term thematic investing.

The remaining 2.8 per cent said it was between 30 per cent and 50 per cent.

Thematic investing is a top-down investment approach that relies on research to explore macroeconomic, geopolitical and technological trends such as decarbonisation, changing demographics and deglobalisation.

Wes Wilkes, chief executive at Ntwrk, said themes and thematic investing was a really important part of asset allocation and the profession needed to do better at educating more generally about this.

Wilkes added: “Sadly, most clients wouldn’t know what is meant by thematic investing, and for that matter neither would most advisers; especially when you consider that with the advent of the [exchange-traded fund] and the incredible choice available at low cost, having an element of a strategy or a portfolio with a theme on, say, climate change or even AI is something clients would take an interest in.”

Ross Lacey, director and chartered planner at Fairview Financial Management, said that while clients might not immediately know what was meant by thematic investing, they would, however, expect any fund manager who offered "active management" to be considering where to allocate money — not just based on individual company prospects but also wider sector or industry trends.

Samuel Mather-Holgate, an independent financial adviser at Mather & Murray Financial, added: “Most clients won't know what thematic investing means. In fact, most advisers won't know the specifics of the term.

“That's because it's a purposefully woolly, generic concept used for a variety of different strategies adopted by fund managers trying to justify their fees. If your money manager is not thematically investing, then just use a passive fund.”

ims.jacksonobot@ft.com

Building a thematic investment portfolio

Technology has become a key component in the building of thematic fund portfolios, while the drive to achieve net zero is also accelerating the climate change trend.

Increased digitalisation encompasses various areas, notably artificial intelligence, robotics and automation, and cyber security.

Dan James, head of asset management at Charles Stanley, says the speed of such technological advances has been made possible due to the convergence of declining technology costs, increasingly reliable performance capabilities and the availability of massive amounts of data fuelling machine learning and intelligence.

Meanwhile, the green revolution straddles world investment in electric vehicles, batteries, green energy, renewable heating and energy efficiency.

James adds: “There are some important structural themes we think are important to integrate into portfolios. Broadly, they can be categorised into two areas, which overlap: increased digitalisation and the green revolution. We are also focused on healthcare as a standalone.

“Attention to these themes is an essential component of constructing portfolios, not just in terms of prioritising beneficiaries of these trends but avoiding the areas and stocks that may be the wrong side of change.

"There are various passive strategies that we use to express our conviction in these themes within portfolios, as well as individual stock selection.”

The perceived complexity of thematic strategies can sometimes deter investors or advisers who are comfortable with conventional methods of investing

Popular themes

For Gillian Diesen, client portfolio manager, thematic equities, at Pictet Asset Management, the themes she likes depend on investors and what their existing allocation looks like.

Premium brands, a strategy that invests in companies across the broad consumer space that offer products and services to cater to consumer aspirations, has seen strong interest from investors year-to-date, she says.

And for many investors it has been a way to play emerging markets through developed market listed (primarily European) equities and tap into trends, including the post-Covid-19 reopening across Asia.

She adds: “Equally, interest has been particularly strong among larger investors seeking tailor-made options in thematic solutions, which can be built using blocks of individual themes in order to cater to investors’ existing allocation needs, as well as to their areas of interest.

“We do not do top-down theme allocation... portfolios are constructed in order to be well positioned to outperform the broader market over economic cycles.”

At Sarasin and Partners, Jerry Thomas, who is the chief investment officer, says the asset manager has identified five long-term megatrends it says will endure for decades.

These are: ageing; climate change; automation; evolving consumption; and digitalisation.

Thomas adds: “Within each of these themes, we have several sub-themes to further help narrow our focus on particular areas of opportunity.

“For example, while AI might be a big driver of market returns recently, it is only one of several areas we’re looking into within our automation theme.”

Advisers

According to Thomas, retail investors tend to be more familiar with traditional investment approaches, such as those with a regional or sector bias.

Therefore, they may not have come across thematic investing or understand what makes it different and what the benefits are.

Thomas says thematic investing requires a different mindset, as it focuses on themes linked to macroeconomic, geopolitical and technological trends, and can span multiple continents and industries.

He adds: “The perceived complexity of thematic strategies can sometimes deter investors or advisers who are comfortable with conventional methods of investing.

“Additionally, the wide use of jargon and terminology in the investment industry can be overwhelming, leading to a lack of understanding about what ‘thematic investing’ actually means.”

Thomas says he hears from advisers that investing thematically offers them a unique way to capitalise on long-term trends and disruptive technologies, and they highlight how it allows clients to align their investments with personal interests and values.

Additionally, many focus on the importance of diversification in thematic portfolios in order to manage risk effectively. Some advisers avoid recommending single-theme funds to clients because they are inherently less diverse and can therefore carry more volatility.

“For example, themes like technology and robotics/AI, tend to be more ‘growth-focused’ in style and have a long-duration profile, meaning they are more sensitive to interest rate rises,” he adds.

“However, we adopt a multi-theme approach in our core strategies, which helps diversify risk and neutralise style bias. Overall, we think that advisers recognise the potential of thematic investing when it is combined with thorough research.”

According to James, one of the broader challenges that the retail sector faces is that risk-profiling tools lend themselves to a portfolio construction technique that is simply focused on the absolute level of risk assets in the form of equities.

This often prohibits, he says, the inclusion of themes and the recognition of different types of risk assets.

In reality, their interaction with other assets in a portfolio and their ability to provide asymmetric risk profiles can be attractive in overall portfolio diversification, and should not be overlooked, he says.

James adds: “Thematic investing has been embedded within portfolio construction for a long time, and is something that the retail market has openly adopted from its institutional counterpart.

"It is an integral part of our central investment proposition and ensures that we can apportion the appropriate levels of risk to themes that are current and/or emerging across the global opportunity set.

“They often demonstrate diversifying qualities at the portfolio level, and it is therefore important to consider sizing in the context of the overall portfolio to optimise the return balanced against risk.”

Megatrends represent the major shifts that will have an impact on the economy, society and environment. Pockets of the economy will benefit more from the tailwinds of these long-term secular growth trends than others – these are essentially themes

Likewise, Diesen says thematic investing has only grown to be a more mature portion of the equity market landscape over the past decade, removing its reputation as niche.

She adds: “It is not surprising that it is less well-known by a significant portion of the financial adviser community.

"It is also likely that a number of advisers are familiar with specific thematic strategies, for example water or clean energy, without knowing that they belong to the broader category of thematic investing.

“More advisers could benefit from using thematic investing in their business for the reasons below.”

Diversification

According to Diesen, advisers who use thematic investing with their clients often see value in three different ways:

- Thematic investments tend to be more tangible than broad market portfolios. Given the right theme, clients can better identify with the holdings in the portfolio.

- Thematic equities tend to provide diversification benefits relative to more traditional equity market vehicles, thanks to low overlap with broader market indices, higher small and mid-cap exposure and unconstrained geographic and sector exposure.

- For sustainability-minded investors, some thematic portfolios are attractive as they invest in companies whose products and services contribute to mitigating specific environmental or societal challenges.

In trying to come up with funds and build portfolios, Diesen says she looks to identify the long-term secular growth trends, that is, “megatrends“, which will change the way we live 30-50 years ahead, and by working together with experts from a variety of fields including those who sit on the advisory boards of Pictet’s various funds.

She adds: “Megatrends represent the major shifts that will have an impact on the economy, society and environment. Pockets of the economy will benefit more from the tailwinds of these long-term secular growth trends than others – these are essentially themes.”

While Charles Stanley does not typically run specific thematic funds, it looks to invest in a way that aligns its portfolio to its thematic view.

It looks for thematics that are forming as part of a top-down view, such as green-led recovery and the digital revolution.

James adds: "We then focus on distilling the exact focus; for example, our green transition thematic focuses on green technologies including electricity generation, electric vehicles and batteries, as well as areas where market share is increasing due to receiving significant government support.

“We then move to the portfolio construction phase where we determine the optimal implementation strategy."

This might be a direct focus, such as the generation of energy via wind or solar, or second-order effects looking at major beneficiaries of the trend – for example, in the manufacture and production of specific component parts.

"We are conscious of the duration impacts of some infrastructure products, and take that into consideration with respect to the overall portfolio exposure to fixed-income assets," he adds.

Role in portfolio

When it comes to how thematic funds fit into a portfolio in the current economic environment, at Pictet, Diesen says she has observed that clients include thematic funds within their portfolios in a variety of ways.

These are typically as satellites to core allocations, as dedicated pockets within a global equities allocation, or within some form of alternatives or even sustainability pocket.

Diesen says that thematic funds work across "different sectors, geographies, market cap sizes and are benchmark agnostic, allowing for a highly differentiated portfolio with high active share vs broad global market indices.

“Each theme has strong characteristics, defined by the structural specificities of its opportunity set, which determine whether a fund is more oriented towards a specific geography, sector or market cap size.

"For example, the nutrition theme that invests across the food value chain from farm to fork is often more biased towards European, mid-cap companies and consumer staples as a sector”.

We are conscious of the duration impacts of some infrastructure products, and take that into consideration with respect to the overall portfolio exposure to fixed-income assets,

Diesen explains further that themes can be thought of as a set of building blocks that can be used on their own or combined to build something new to complement an investor’s portfolio.

This is the difference between a single-theme strategy or a meta-theme strategy – in which the factor exposure biases of a single theme can be mitigated through multiple theme combinations according to a client’s needs.

Ima Jackson-Obot is deputy features editor at FTAdviser

How will challenges to globalisation impact thematic investing?

A look at the impact of "deglobalisation" on some of our favoured themes: smart manufacturing, energy transition and climate change, and the circular economy.

A three-decade long process of globalisation is facing a number of challenges:

- Geopolitical tensions between the US and China have been growing for some time;

- Supply chain disruptions stemming from the Covid-19 pandemic have forced companies to consider whether resilience is more important than cost;

- Russia’s invasion of Ukraine highlighted the risks of relying on a small handful of suppliers for key commodities like natural gas.

Security is becoming a paramount concern, whether that be in terms of defence, energy supplies, or security of information or technological know-how. The result has been strengthening headwinds facing “globalisation” and an unpicking of some of the trends of recent decades. We believe this will have a knock-on effect on many aspects of corporate behaviour.

Certain investment themes will be particularly in the spotlight as a result. Here, we look at the impact of this process of deglobalisation on some of our favoured themes: smart manufacturing, energy transition and climate change, and the circular economy.

Smart manufacturers enable industrial independence

Manufacturing reshoring or “near shoring” – bringing production closer to a company’s home market – is already happening. Smart manufacturers stand to gain the most from this shift. They are the suppliers of sustainable new innovations in hardware, software and new materials, and therefore are the facilitators of this desired manufacturing independence.

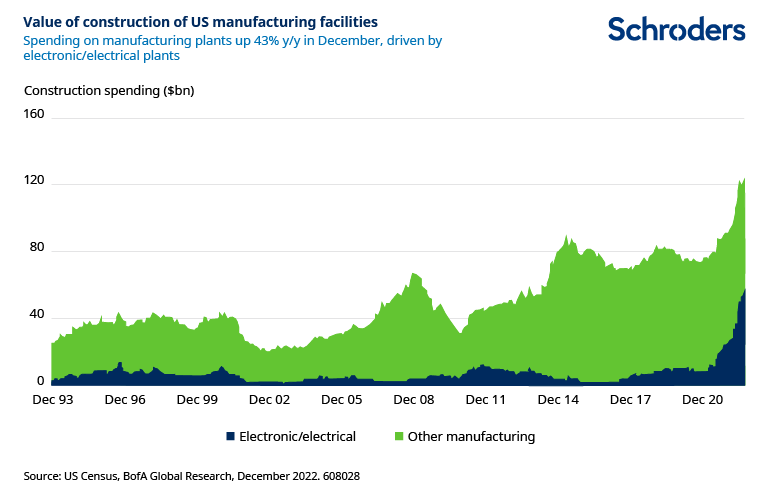

The semiconductor sector is leading the reshoring charge. US concerns about overreliance on China for manufacturing high-end semiconductors led to the passing of the Chips Act in 2022. This includes $52.7bn of incentives for semiconductor research & development and manufacturing.

And it goes beyond chips. The US has also passed the Inflation Reduction Act, which envisages the mobilisation of $1.5tn of capital into clean energy, including advanced manufacturing production credits. Europe has followed suit with its Green Deal Industrial Plan, which offers €390bn of funding to enhance the EU’s manufacturing strength in strategic technologies like solar and wind energy, heat pumps, and batteries.

Part of the aim of these plans is to ensure secure supply of the critical technologies needed for major shifts in digitalisation and the transition to green energy. Part of it is also to create skilled jobs and “future-proof” the competitiveness of the US and European economies.

Smart manufacturers are also at the leading edge of the wave of innovation in artificial intelligence (AI) and robotics. Using robotics can bring down the cost of switching from a low labour cost destination to a higher cost one. This may be especially important in regions where there are already labour shortages.

Like many Western nations, China is facing a demographic challenge as the working age population shrinks. Labour shortages tend to push up wages, potentially encouraging companies to invest in automation.

Innovations such as embedded artificial intelligence and better vision systems, as well as price deflation, are making automation investments the most economically attractive they have ever been. Smart manufacturers producing equipment such as robotics or sensors will be the winners here.

Russia-Ukraine war highlights importance of energy security

The imperative to switch from fossil fuels to green energy in order to limit global warming is well understood. But part of the reason why governments are keen to invest in energy transition technologies is to ensure security of supply. The danger of relying on others for energy has been demonstrated by the impact of Russia’s invasion of Ukraine on natural gas prices.

Countries could be self-sufficient in energy if they rely on wind, solar, wave, or biomass power. This is part of what has prompted the wave of government stimulus directed at renewable energy – such as the US IRA or EU GDIP mentioned above.

Of course, just because governments are seeking to expand renewable energy capacity and attract renewables firms to their countries doesn’t mean that only companies domiciled in those countries will benefit. Many of the companies that will benefit from the push for energy security and investment are global operators.

The supply chain disruptions witnessed as a result of the pandemic have been detrimental for many of the companies operating in the energy transition space. Company earnings and valuations have suffered amid higher raw materials costs and logistical challenges. But those are short-term impacts compared to the long-term structural shift towards renewable energy.

Circular economy keeps goods and materials in use locally

The move towards a more local supply chain also plays into the circular economy theme.

A circular economy delivers what consumers need without accepting that materials will be discarded and pollution created in the process. It challenges the existing “take-make-waste” approach, which consumes finite resources that are used briefly, and then discarded, often directly to landfill. A circular economy designs products and services with efficiency, reusability and recyclability in mind.

Keeping products and materials in use locally reduces reliance on distant suppliers, enabling simpler logistics and reducing energy consumption.

David Docherty is investment Director - thematics at Schroders

The views and opinions contained herein are those of Schroders’ investment teams and/or Economics Group, and do not necessarily represent Schroder Investment Management North America Inc.’s house views. These views are subject to change. This information is intended to be for information purposes only and it is not intended as promotional material in any respect.